The Solar Investment Tax Credit is partly responsible for recent significant solar energy capacity growth, but it needs to be extended.

In the last quarter of 2019, U.S. representatives have drafted legislation to aggressively address climate change through a more robust clean energy policy. Among new changes within this proposed law, a primary focus is to revisit existing tax incentives for a third time.

The investment tax credit (ITC) and production tax credit (PTC) have been in effect for decades, with the purpose of giving incentives to a variety of solar energy and wind energy projects.

Important for all solar power projects from residential to commercial, rooftop mounted to ground mounted and solar canopies, the ITC in its second version became law in 2015. It provides for a 30% federal tax deduction for projects qualified by the end of 2019. Beginning in 2020, there is a scheduled reduction to 26%, followed by and eventual reduction after 2022 to 10% for commercial projects and 0% for smaller projects.

The proposed legislation, The Growing Renewable Energy and Efficiency Now (or GREEN) Act, would add five years to the ITC as well as to the PTC. For many wind energy developers, the expiration of the PTC at the end of 2019 presents a problem.

This new approach is significant in its aim to be more comprehensive than other current renewable energy bills in progress. California Representative Mike Thompson is the champion of this and previous bills, building on the momentum from both energized voters as well as industry advocates. As a continuation and improvement, it is driven by the following:

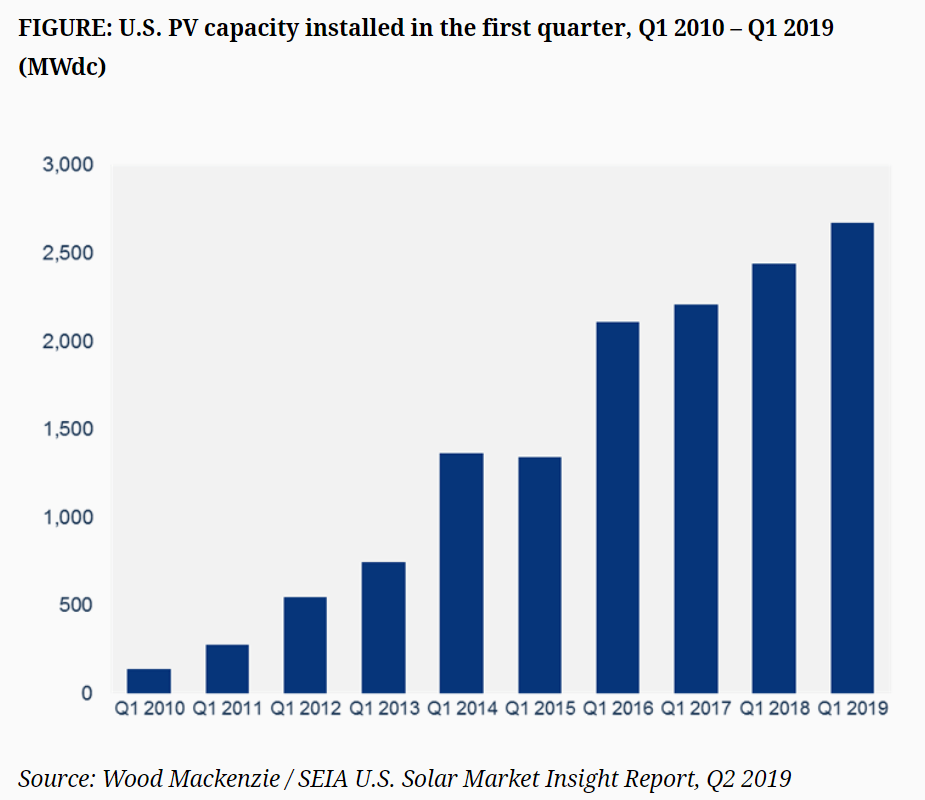

- The original 2015 agreement to modify and reduce tax credits beginning in 2020 anticipated and expected other complementary legislation and activities directly targeting emissions impacting climate. To date, that has not happened. The existing renewable energy capacity growth rate is high, but insufficient to meet future goals relative to climate change.

- Earlier in 2019, a bipartisan trio including Rep. Thompson introduced a solar specific ITC extension bill – The Renewable Energy Extension Act. It seeks a full 5 year extension to the existing 30% ITC for solar energy projects.

- For climate legislation to be more effective, it needs to be as comprehensive as possible.

- Grassroots groups, advocates and local elected officials are pushing more than ever for more effective policy. Just recently, hundreds of mayors have urged Congress to extend the ITC.

We at SunRa Solar are watching this closely and advising Massachusetts congressmen on the importance of getting this right. We encourage all our neighbors and fellow residents to let their congressmen know how important this is. The voice of the voter is key to making progress with any legislation.

To find your local representative click here.